Pre-Market Trading FAQ

1. How to trade in a Pre-Market on KuCoin?

- Locate the token you're interested in.

- Place your trade order by inputting the quantity and price, then confirm.

- Ensure timely delivery of the order within the agreed-upon timeframe.

1.1 How do I Buy as a Maker?

- Choose the token you want to trade.

- Place a buy order by entering the quantity and price. After paying the deposit, confirm your trade.

- Wait for a seller to match your order.

- Once the seller delivers, you'll receive the token. If they fail to deliver, you'll get a default payment and your collateral back.

1.2 How do I Buy as a Taker?

- Locate an existing order that matches what you're looking for.

- Accept the sell order, pay the collateral, and confirm.

- After the seller's delivery within the agreed timeframe, you'll receive the token. If they don't deliver, you'll get a default payment and your collateral back.

1.3 How do I Sell as a Maker?

- Choose the token you wish to trade.

- Set up a sell order, inputting the desired quantity and price. Secure the collateral, then confirm the trade.

- Wait until KuCoin activates the trading pair in the main market.

- Ensure timely delivery to get the buyer's collateral. Failure to deliver means you lose your collateral.

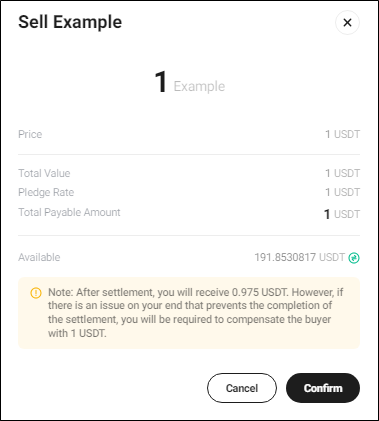

1.4 How do I Sell as a Taker?

- Identify an existing order you're interested in.

- Accept the buy order, secure the collateral, and confirm.

- Once KuCoin activates the trading pair in the main market, proceed.

- Deliver on time to receive the buyer's collateral. Otherwise, you'll lose your collateral.

2. How to Complete Delivery

Normally, there’re two ways of delivery.

2.1 Deposit Tokens

- Ensure you have the correct Token Ticker and deposit Address.

- Transfer enough token to spot trading account and wait for delivery time.

2.2 Purchase enough tokens in the market, transfer enough token to spot trading account and wait for delivery time.

Note: Ensure tokens are stored in your spot trading account. Tokens in any other account (e.g., a funding account) won't be recognized for delivery and you may loss all your collateral.

3. What is the Pre-Market on KuCoin?

The Pre-Market is a unique platform on KuCoin that allows users to trade tokens before they're officially listed. It's like getting early access to new token listings.

4. How does the Pre-Market differ from KuCoin futures?

The Pre-Market on KuCoin is specifically for trading tokens before they're officially listed. Unlike futures, where you're buying a contract based on future prices, in the Pre-Market you're directly trading the tokens themselves. At present, the Pre-Market on KuCoin is primarily designed for over-the-counter (OTC) trading of tokens before they are officially listed. This OTC nature means that trading is not continuous, unlike in futures.

5. Is Pre-Market trading riskier than regular trading?

Like all trading, there are inherent risks. However, the Pre-Market has its own set of risks and rewards. Ensure you understand the terms, especially regarding delivery times and collateral, before you begin trading.

6. How are prices determined in the Pre-Market?

Prices in the Pre-Market are determined by the buyers and sellers. They can set their own quotes, which may differ from the prices once the token is officially listed.

7. What happens if I can't complete my trade within the agreed time?

If you fail to complete your trade within the stipulated time, there might be penalties, such as losing all your collateral. Always ensure you can meet the trade's conditions.

8. How is liquidity ensured in the Pre-Market?

Liquidity is primarily ensured by the traders themselves. As it's an over-the-counter (OTC) market, buyers and sellers set their quotes and lock in prices and liquidity in advance.

9. If a token's value dramatically drops after the Pre-Market but before official listing, am I at a loss?

No, you wouldn't incur a loss in the same way as with futures contracts. However, market risks like these exist. It's important to note that the value of a token can fluctuate between the Pre-Market trading time and its official listing. It's crucial to do thorough research and be prepared for such scenarios (DYOR).

10. Do Pre-Market trades affect the token's initial listing price on KuCoin?

While Pre-Market trades give an indication of interest and potential value, the official listing price might be influenced by a broader set of factors, including overall market conditions.

11. How are collateral rates determined?

Collateral rates are set to ensure the security of trades in the Pre-Market. These might be based on a variety of factors, including the token's perceived risk and volatility.

12. What if the token doesn't get listed or is delayed?

If a token's listing is delayed or cancelled, the Pre-Market will adjust its operations accordingly. Please refer to our guidelines on "New token Delayed or Cancelled" for detailed procedures.

13. Can I cancel a trade once I've confirmed it?

Uncompleted orders can be cancelled without incurring fees. However, completed orders remain in place until the token's official listing or if the listing is cancelled.

14. How are Pre-Market fees calculated, and are they different from regular KuCoin fees?

Pre-Market fees are typically 2.5% of the total traded amount, but they can vary based on the token. These fees are distinct from KuCoin's main market fees.

15. Can I use leverage in the Pre-Market?

Currently, the Pre-Market does not support leveraged trading. You'll need to have the full amount of funds or tokens you wish to trade.

16. What are the consequences if the delivery of a token is not made on time?

Not delivering on time can result in the loss of collateral, and your trading privileges in the Pre-Market may be reviewed.

17. Are there any country-specific restrictions for Pre-Market trading?

Pre-Market trading follows the same country-specific restrictions as regular KuCoin trading. Always ensure you complete the Identity Verification (KYC) and you're compliant with your local regulations.

18. What happens if there's a system outage during a Pre-Market trade?

KuCoin has robust infrastructure in place to handle such scenarios. In the rare event of an outage, the platform will provide guidance on how affected trades will be managed.

19. Are Pre-Market trades anonymous?

Like other trades on KuCoin, Pre-Market trades are designed to protect users' privacy. Other users won't see your personal details, just the trade details.

| 다음글 | |

| 이전글 |